Questions

Questions:

- Can we beat internal benchmark for sugar/corn purchase strategy for a beverage manufacturer?

- Can one incorporate a company purchase policy into a systematic process?

Approach:

needs three pieces of information from the client

needs three pieces of information from the client

- Volume of purchase: Example 100 MT

- Period of purchase: Example 1Jan-30 Jun’23

- Any specific policy to incorporate within the purchase program

system will focus on a limit + market order approach to decide when to buy and how much to buy

system will focus on a limit + market order approach to decide when to buy and how much to buy

Methodology

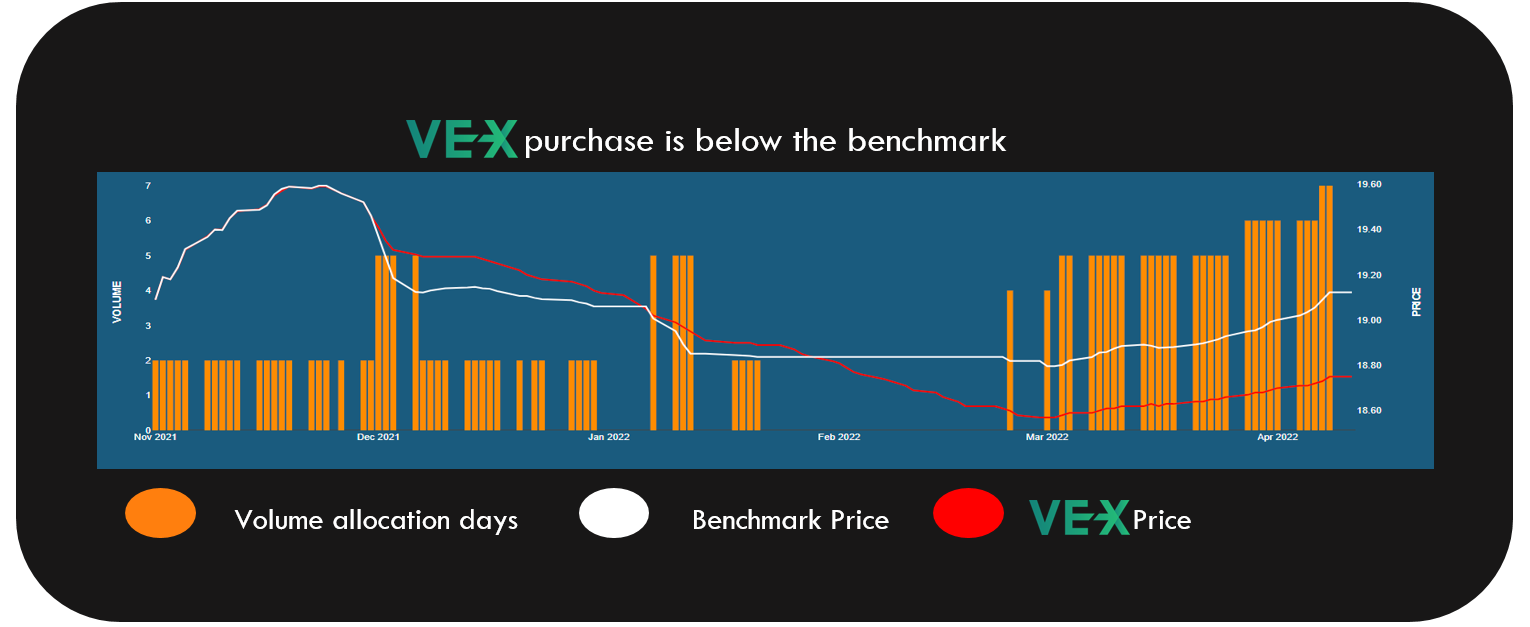

- The major challenge is to beat the benchmark while keeping up with the policies set by client in the purchase program

- The benchmark on any day is calculated as the simple moving average of the daily settlement prices from the start of the purchase period

- A typical purchase order would contain a price and a volume recommendation

- If a purchase order is a market order (MO), the recommended volumes are typically executed at close

- If a purchase order is a limit order (LO), the recommended volumes need to be executed at a certain recommended price and that price could be out of range sometimes in which case there would not be any execution

- The decision to purchase, the type of order and volume allocation for the following day is dependent on two factors

- whether today’s settlement price is above the benchmark (case A) or below the benchmark (case B)

- the recent trend in the daily settlement prices – up or down or uncertain

- In case A, the purchase order could be a MO or LO based on the trend and if the LO is not filled, the volumes for that day are filled at close as the edge over benchmark that could be possibly present in this case should be captured at any cost

- In case B, the purchase order could be a MO or LO based on the trend again and if LO is not filled, the volume allocation logic would carry forward them for execution in the upcoming days

- As the desperation to fill volumes in case A is more than in case B, a volume acceleration/deceleration logic is used which would fill more volumes in a typical case A scenario than in a typical case B scenario

- This systematic purchasing strategy would make sure to fill all the volumes mentioned in the policy by the end of the purchase period

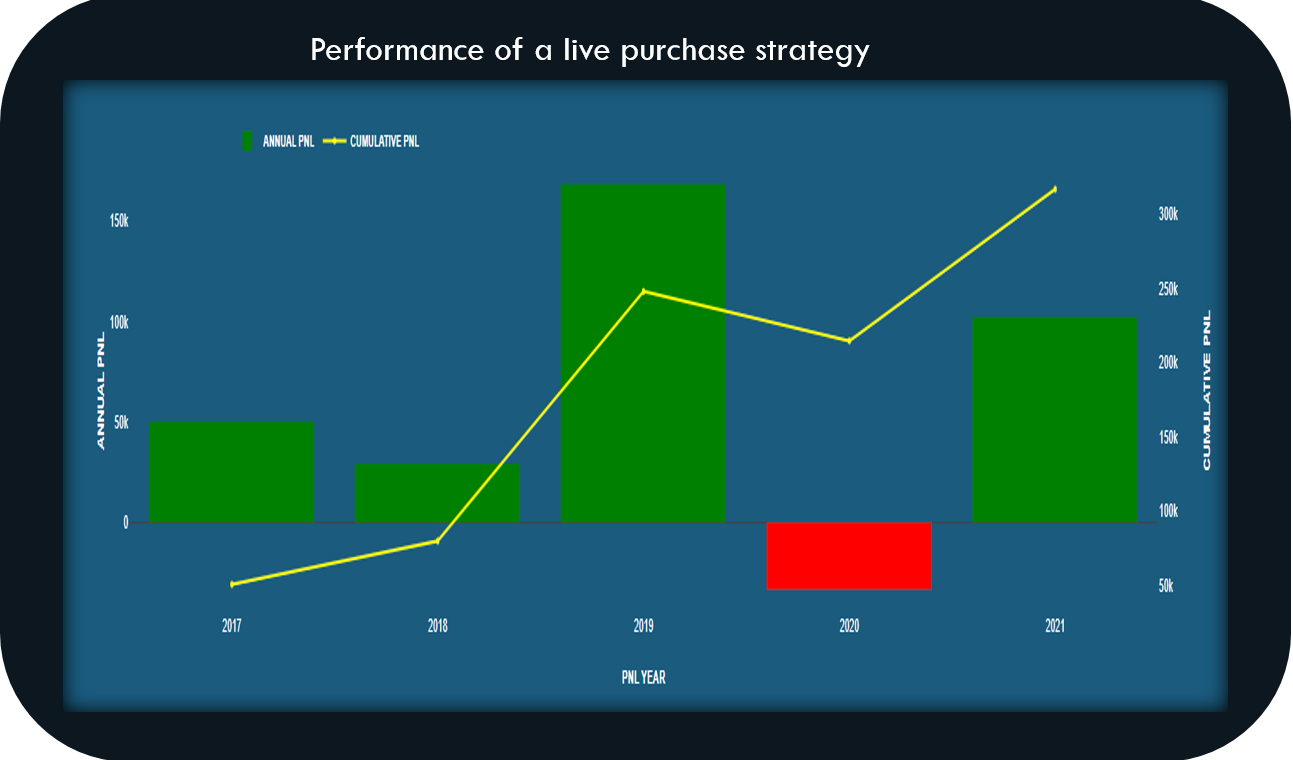

Performance

- The performance for the purchase strategy is defined by the difference between the average purchase price and the benchmark price

- There are four internal parameters on which the performance of the purchase strategy depends –

- moving average window sizes

- volume multipliers which define the amount of volume acceleration/deceleration

- execution probability that defines the LO price

- threshold to classify the price trend

- Hyper-parameter tuning is done over the in-sample period to select the set of parameters for the out-sample period data with the objective of consistently beating the benchmark in out-sample period while maximizing the edge over the benchmark

- Along with the internal parameters, there are external factors like global macro conditions, price regimes, etc., that could also define the performance of the purchase strategy

Conclusions

- This purchase strategy helps the clients buy the required volumes of corn/sugar at lower prices than buying equal number of volumes per day over the purchase period

- The allocations from this purchase strategy are generated automatically everyday without any human intervention

- As there are number of internal, external and client purchase policy factors impacting the performance of the strategy, there could be periods with losses

- However, the internal factors are chosen in such a way that the performance is expected to be consistent across years

- This product,

Enhanced Returns , which generates the buy/sell strategies is very much flexible to consider most of the policies of the clients

Enhanced Returns , which generates the buy/sell strategies is very much flexible to consider most of the policies of the clients - The ability to adhere to the various policies from different clients while also generating the performance and beating the benchmark makes

Enhanced Returns stand out as a unique smart product in the market

Enhanced Returns stand out as a unique smart product in the market